Exchanges have always been an integral part of the cryptocurrency ecosystem. Whether the trading of coins happened on forums, centralized platforms or decentralized exchanges, trading cryptocurrency is one of the first things anybody who is introduced to crypto does. We have seen many models of exchanges and have seen evidence of the difficulties that come as a result. Whether it’s the fall of MtGox or the EtherDelta hack, there is no shortage of problems with these businesses. This is where Gold.io comes into play. The platform features a decentralized exchange based on the EOS platform, but with a twist.

What is Gold.io exactly?

Before we talk about what Gold.io has to offer, let’s go over some of the issues with current exchanges. Centralized exchanges suffer from the following issues:

- Vulnerability to malicious attacks.

- The need for clients to provide personal details

- High trading fees

- Charging assets an exuberant amount for listing fees

- Insolvency

While the creation of decentralized exchanges does solve most of the above issues, some problems still remain. DEX’s suffer from the following issues:

- No pairing to fiat

- Centralized hosting (EtherDelta hack)

- Lack of efficient inter-chain communication.

These are only a few problems that plague the current models of Decentralized Exchanges. GOLD.IO aims to solve the above issues with the help of a Decentralized Autonomous Community or DAC. Along with a revised infrastructure on the EOS platform, implementing a DAC will create self-governance that will allow the community to “steer the direction of the exchange.” According to Gold.io’s goldpaper:

“The GOLD.IO community will self-manage the majority of the operational aspects

of the exchange process through the pre-established smart contract functionality.”

In order to solve the first problem of pairing assets to fiat, Gold.io’s infrastructure will allow the listing of stablecoins which is made possible with the use of cross-chain transactions. Centralized hosting is avoided with the use of sisterchains, whose producers are geographically dispersed. Last but not least, lack of efficient inter-chain communication problem is solved with the instantaneity of the exchange, which is made possible by using EOS as the underlying platform.

Funding Process

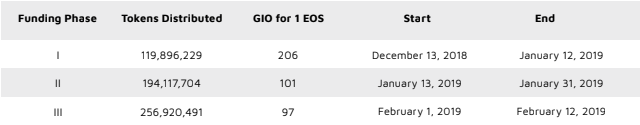

According to their funding document, Gold.io will initially distribute roughly 570 million GIO tokens – which comes down to 21% of all the airdrop and funding supply. The funding stages are shown below:

“Participants in this funding round will be able to trade the tokens after the three phases are complete and the token is listed. Also,

the contributors are awarded significant discounts as compared to the airdrop claiming fees. Unsold tokens are burned.”

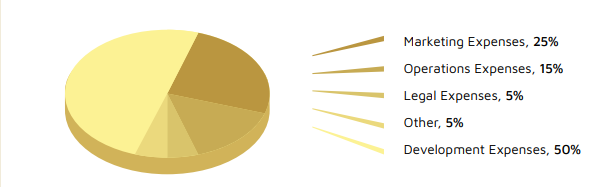

The funding will be used to cover various expenses such as marketing, operations, legal and development. You can find a detailed chart below:

To recap, the total token distribution is as follows:

- Total supply: 3,018,735,360.00

- Team tokens: 300,000,006.00

- Funding distribution: 570,934,424.34

- Airdropped: 2,147,800,929.66

One concept that might confuse people is how the airdrop is not free and is instead frozen. The funds raised from the airdrop will be used by the DAC to vote what to do with them. The plan is to back all tokens with real gold, but the at the end of the day the community will decide exactly what happens.

If you are looking to participate in the airdrop check out this youtube video for an explanation:

Another point worth mentioning is the soft cap (2M) and hard cap (11M) for the project. Keep in mind the tokens raised from the airdrop do not count towards either of the caps.

Eugene Goldenberg, managing director for Gold.io said:

“The community that invested in the early stages of the seed funding and the seed drop will be voting (we are a DAC) on what to do with the frozen tokens, and the raised amount from the airdropped tokens. The first proposal that we would do for voting is to back the tokens with gold from the proceeds of the airdrop.”

About the Gold.io team

When looking at the Gold.io website you will notice there are no LinkedIn profiles. While some may criticize the project for a lack of transparency, the Gold.io team instead has included the Github accounts of the project’s contributors. After all, what is more important to a crypto project, a bunch of linked in profiles with 500+ connections or robust developer accounts with proven track records?

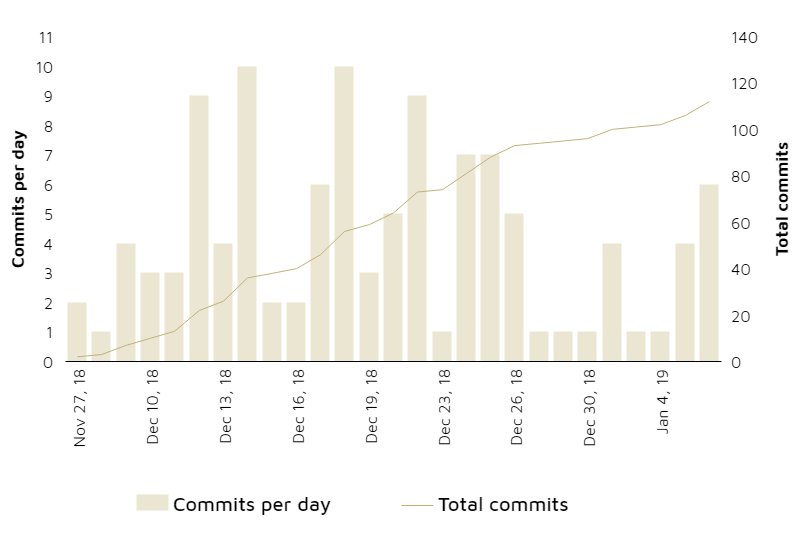

Looking at the Gold.io website you will find a list of 15 Github accounts. Furthermore, there is a chart with the amount of commits per day, the activity by far exceeds most established crypto projects.

Gold.io promises a revolutionary decentralized exchange built on the EOS platform. Furthermore, with their tiered funding system and airdrops it provides ample opportunities for anybody interested in becoming a part of the project.

Useful Links:

If you would like to join the Gold.io team you can send them an email at info@gold.io

Visit the Gold.io website here: https://gold.io/

Checkout the goldpaper for more info.

Checkout more info about the funding process here.

This is a sponsored article and does not necessarily reflect the opinions or views held by any employees of NullTX. This is not investment, trading, or gambling advice. Always conduct your own independent research.

The post GOLD.IO – A Decentralized Exchange With Built in Self-Governance appeared first on NullTX.