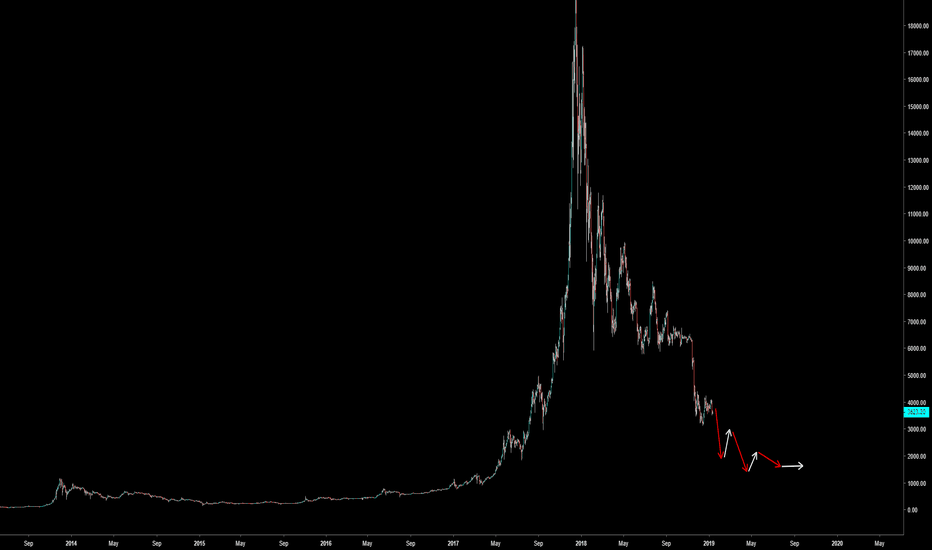

At press time, the father of cryptocurrency is still trapped in the $3,600 range. Following a near two-week period of meandering about at $4,000, bitcoin is still struggling to regain traction in the crypto market.

Interestingly, the Federal Reserve Bank of St. Louis has released an argument that seemingly blames altcoins for bitcoin’s latest demise. The authors claim that the cryptocurrency arena is consistently flooded with new altcoins that do little to move the market forward in a positive way. The space has become saturated and cannot change as it should due to the limited space.

Chart by SkylerBTC

At the same time, however, bitcoin appears to be suffering from a lack of awareness. Regarding bitcoin decentralized applications (dApps) for example, very few people use them, and instead prefer dApps centered on other competing currencies like Tron. The authors say a bitcoin maximalist argument has never fully come to fruition, writing:

“Consider the following thought experiment. A restaurant selling meals for ten dollars will happily accept payment in the form of one Hamilton bill ($10) or two Lincoln bills ($5). That is, the nominal exchange rate between Hamilton and Lincoln bills is 2:1. Now, suppose that the supply of Lincoln bills is increased but the supply of Hamilton bills remains the same. The exchange rate remains unaffected… That is, the increase in the supply of Lincoln bills has led to a decline in the purchasing power of both Lincoln bills and Hamilton bills, even though the supply of Hamilton bills has remained fixed. Might an expansion in the supply of altcoins have a similar depressing effect on the price of bitcoin?”

In addition, the authors comment that bitcoin has ultimately lost some of its meaning over the years. For instance, there was a time when initial coin offerings (ICOs) were primarily conducted for and around bitcoin. However, now Ethereum has taken over that position. ICOs largely center on Ethereum-based tokens, making it a solid competitor to bitcoin’s once superior nature.

They also write:

“Consider now, the bearish case for bitcoin. This outlook is based on the view that bitcoin has no fundamental value and that, sooner or later, the market will recognize this fact. In our view, one can accept that bitcoin trades above its fundamental value without claiming that its fundamental value is zero. In fact, many securities trade or sell beyond what might be considered their fundamental value. Gold, for example, trades above its value as measured by its industrial applications.”

While the article doesn’t say that bitcoin will ultimately sink down to zero or become non-existent, the authors are reluctant to suggest it could potentially make any serious mark on the industry in the immediate future, especially considering how much money is now flowing into crypto alternatives.

Bitcoin Charts by TradingView

Image(s): Shutterstock.com

The post Bitcoin Price Watch: Are Altcoins to Blame for Bitcoin’s Demise? appeared first on NullTX.