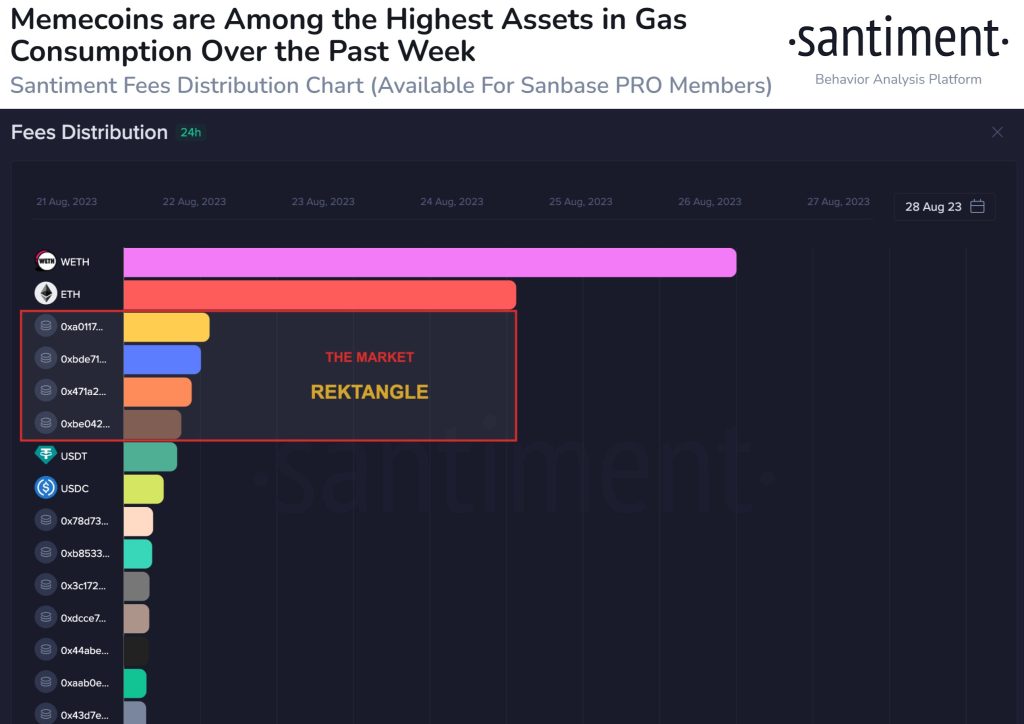

In recent times, the metrics tracking of fee distributions among assets by @santimentfeed reveals an intriguing development: certain memecoins have managed to surpass established stablecoins like $USDT and $USDC in terms of gas consumption. This atypical phenomenon is commonly observed during periods of heightened speculative trading activity.

Trading Volume And Transaction Frequency Increase

The surge in gas consumption among these #memecoins suggests a significant increase in trading volume and transaction frequency. This, in turn, reflects the speculative nature of the trading occurring within these tokens. Speculators are attracted to volatile assets like memecoins, often aiming to capitalize on short-term price fluctuations. As a result, a higher number of transactions takes place, leading to increased gas consumption on the blockchain network.

Shift In Market Sentiment

The shift in gas consumption from stablecoins to memecoins indicates a shift in market sentiment. Investors are seemingly diverting their attention away from stable assets and embracing the riskier and potentially more rewarding world of memecoins. However, this heightened activity also raises concerns about network congestion and higher transaction fees, which might impact the overall user experience and accessibility of the blockchain.

Conclusion

In conclusion, the recent trend of certain #memecoins surpassing established stablecoins in gas consumption underscores the speculative nature of the cryptocurrency market. This occurrence highlights the dynamic and evolving nature of the blockchain ecosystem, where market sentiment and investor behavior play a crucial role in shaping trends. As the landscape continues to evolve, it will be important to monitor how these developments impact network stability, user experience, and the broader cryptocurrency market.

Disclosure: This is not trading or investment advice. Always do your research before buying any cryptocurrency or investing in any services.

Follow us on Twitter @nulltxnews to stay updated with the latest Crypto, NFT, AI, Cybersecurity, Distributed Computing, and Metaverse news!